Guavapay Retail App

Guavapay is a fast-growing global payments enabler trusted by over 100,000 active users worldwide. The platform simplifies cross-border financial interactions by combining transparent digital banking, multi-currency support, and localized payment services in one universal app.

Built to scale internationally, Guavapay helps individuals and businesses manage money across countries with clarity and control — from everyday spending and cashback rewards to credit and partner offers — while maintaining a user-friendly, globally consistent experience.

Subscription

Bundles is a subscription layer inside the Guavapay that bundles financial benefits into themed plans (Travel, Transfer, Student), combining higher cashback limits, better FX rates, partner subscriptions, and operational perks. The product connects everyday banking behavior with predictable recurring revenue while helping users clearly understand and maximize the value they receive from the subscription.

The goal was to increase subscription adoption, retention, and perceived value while keeping pricing and benefits transparent and easy to compare. My scope covered end-to-end product design: discovery and entry points across the app, personalized targeting logic, bundle positioning, comparison and decision flows, activation and payment setup, trial mechanics, and cancellation experience — including retention levers and downgrade logic.

I designed the system from scratch, starting with how users discover bundles through banners, push notifications, contextual placements, and embedded entry points such as card customization. I worked on data-informed targeting rules that surface the most relevant bundle based on user behavior, balancing personalization with predictability. The activation flow was optimized around clear value communication, bundle-specific layouts, transparent pricing, and smart defaults for subscription periods. I also designed comparison tools, trial logic, and cancellation flows that surface real savings and alternative offers to reduce churn without adding friction.

Result: a scalable subscription platform embedded into everyday banking journeys, balancing monetization, personalization, system clarity, and long-term retention.

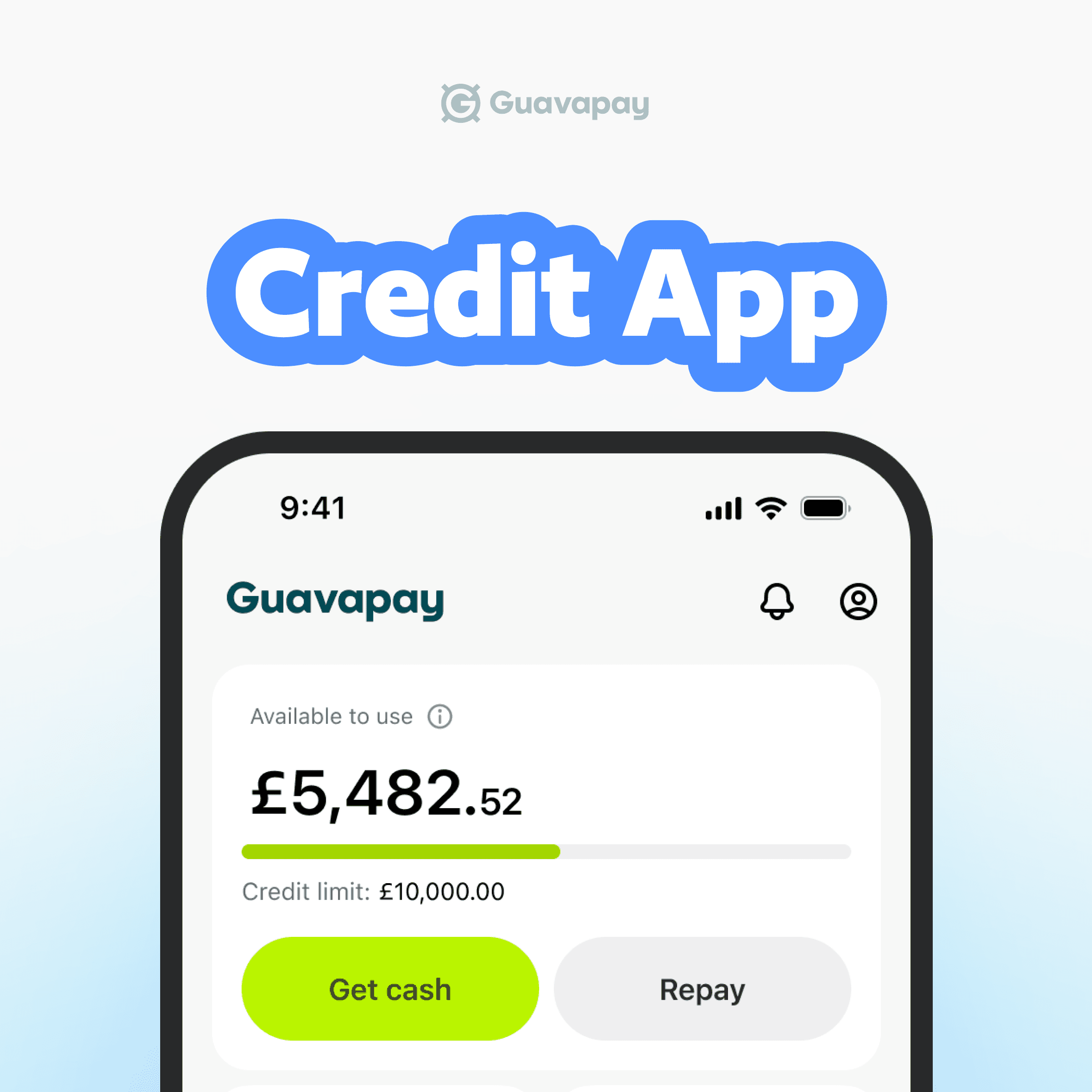

MyGuava Credit app

View in Figma upon request

I designed the MyGuava Credit app end to end — from navigation structure and core flows to edge cases and operational scenarios. The product focuses on making credit usage transparent, predictable, and easy to control, helping users clearly understand their balance, limits, repayments, and upcoming obligations without cognitive overload.

The experience is built around simple, role-based navigation and strong self-service: quick access to cash, repayments, transaction history, documents, and support, combined with clear visibility of APR, payment schedules, and account status. My goal was to reduce anxiety around credit, remove hidden complexity, and create a calm, trustworthy financial experience that scales reliably as the product grows.

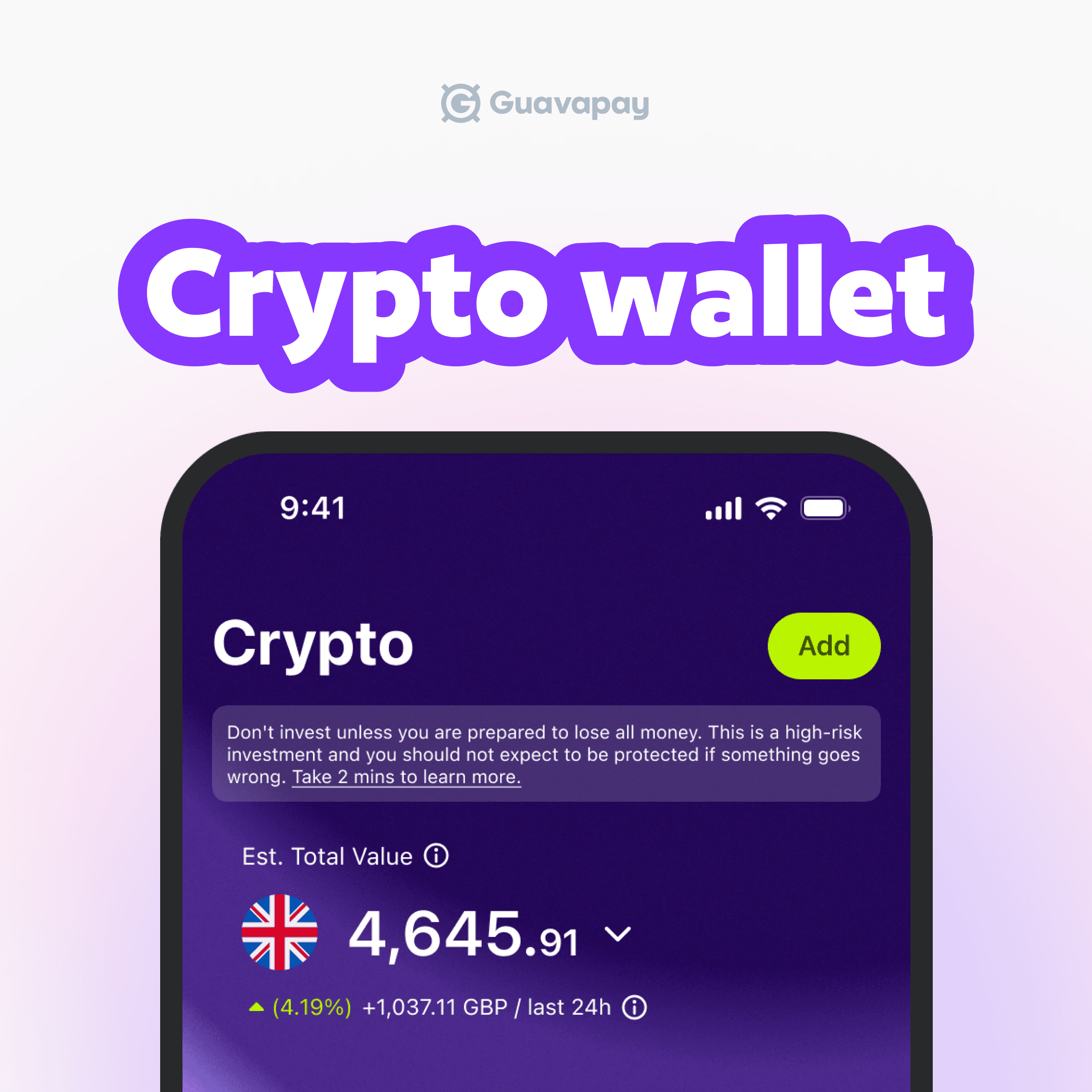

Guavapay Crypto wallet

I worked on the Crypto Wallet experience inside the Guavapay app, redesigning the main crypto dashboard to make portfolio status, asset distribution, and key actions clearer and easier to navigate. I simplified asset management flows, improved information hierarchy, and made charts more interactive and insight-driven, helping users better understand performance and dynamics without increasing cognitive load.

In parallel, I prepared the product architecture and UX for upcoming crypto card functionality and card management, ensuring the wallet could scale without major redesign. I also improved payment speed and safety by introducing Trusted Recipients, reducing friction for repeat transfers while preserving strong security and user confidence.

The result was a more transparent, scalable, and user-friendly crypto experience that balances advanced functionality with everyday usability.

Gift Cards with Choice

Gift Cards with Choice is a B2C feature inside the Guavapay retail app. A user buys a gift card by selecting a category of brands: the sender defines the amount and spending direction, while the recipient distributes the balance across specific brands within that category.

The business goal of the unit was to grow transaction volume and partner revenue through a discount model. My responsibility covered end-to-end product design: UX strategy, user flows, UI, product decisions, and stakeholder collaboration. 3D visuals were created by a graphic designer based on my brief.

I designed the experience end to end: entry points, user flows, purchase and sharing scenarios, and the overall value communication. In parallel, I audited the existing gift section and unified fragmented purchase and sharing flows into a single reusable flow, reducing UX debt and improving platform consistency. I simplified the purchase funnel from nine steps to four, introduced smart defaults, and aligned product decisions with unit economics. I also revisited ownership logic after stakeholder discussions, adding sender access before activation to reduce edge cases and support load.

Result: a scalable, low-friction gifting experience that balanced business goals, system integrity, and user clarity.

Extra Cashback

View in Figma upon request

Partner Extra Cashback is a B2C feature inside the Guavapay app that allows users to earn increased cashback. Users can browse and search offers, save relevant deals, explore partner locations on a map.

The business goal was to increase card usage, partner GMV, and everyday engagement with the app by embedding cashback into real shopping behavior. My responsibility covered end-to-end product design: UX strategy, information architecture, user flows, UI, edge-case handling, and close collaboration with product and engineering.

I designed the experience from scratch: the main discovery screen, search and saved offers, multiple offer detail templates (online, in-store, card-linked, affiliate), and supporting flows such as maps integration and context-based CTAs. I also defined interaction logic for edge cases — offer eligibility, currency and country restrictions, fallback states, and activation mechanics — ensuring predictable behavior across different scenarios.

Result: a scalable cashback platform that connects digital banking with real-world spending, improves offer discoverability, and drives repeat usage through clear navigation, contextual actions, and consistent system logic.